AI and Machine Learning for Predictive Trading — Part 2

Learn about predictive trading strategies that use AI and machine learning. Exegy can help your firm get ahead of even the fastest players.

Learn about predictive trading strategies that use AI and machine learning. Exegy can help your firm get ahead of even the fastest players.

The convenience and control of direct market access added to Software-as-a-Service (SaaS) efficiency opens DMA to a larger group of firms.

Learn about how institutional investors are leveraging artificial intelligence and machine learning to get ahead in an era of data-driven trading.

Iceberg or reserve orders are sources of significant hidden liquidity that can be uncovered using order-level market data.

Exegy’s Liquidity Lamp helps track the trading of large, institutional ‘natural investors,’ a process known as alpha cloning.

As the impact of the Consolidated Audit Trail begins to reverberate through the industry, firms must make plans to ensure their compliance.

We look at the link between the VIX and NBBO quote changes, and show how Exegy’s signal Quote Fuse can help you navigate volatile markets.

The extreme volatility of the past few weeks has dramatically impacted market data rates, but not in ways that you would expect.

An examination of market data from February 2020 shows how firms can gain from volatility using Exegy’s Signum signals.

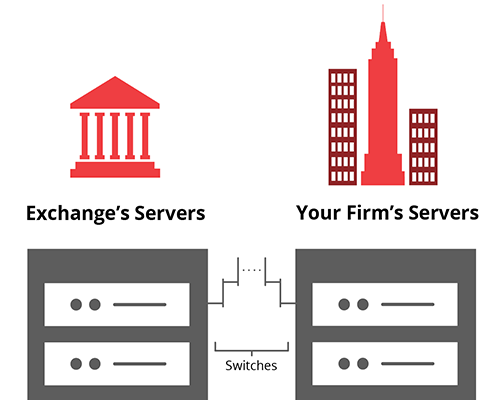

This article outlines common technology, networking, and trading strategy decisions needed to achieve ultra-low latency.