Liquidity Lamp Whitepaper

Liquidity Lamp is Exegy’s Signum signal that accurately identifies reserve (“iceberg”) orders. Download our Liquidity Lamp whitepaper.

Liquidity Lamp is Exegy’s Signum signal that accurately identifies reserve (“iceberg”) orders. Download our Liquidity Lamp whitepaper.

Exegy’s Signum signal Quote Vector predicts the direction of NBBO price changes for US-listed equities. Download our Quote Vector whitepaper.

A review of PG&E reserve order activity as detected by Exegy’s Signum Liquidity Lamp shows the power of this signal.

The US futures market maintains relatively centralized liquidity. Still, understanding the market structure ensures you have defined feed set requirements.

The unique structure of the options market creates conditions that impact liquidity, which can affect alpha capture and execution strategies.

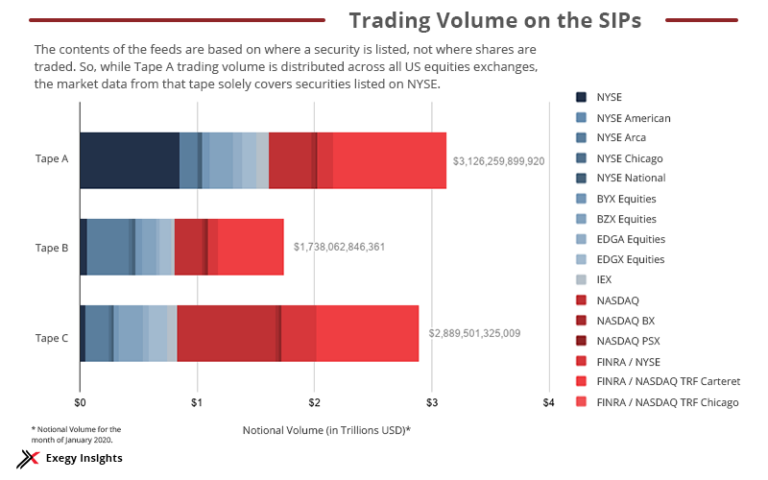

Exegy’s Guide to Market Data Basics for US Equities helps firms understand the types of data available, how to access them, and the fees involved.

Exegy has added IMC equity liquidity venues to its global portfolio of feed handlers.

Market data is the third largest expense for many banks and broker-dealers. Understanding fees can help firms with infrastructure planning and budgeting.

Exegy has filed a patent infringement lawsuit in US District Court against ACTIV Financial Systems, citing unauthorized use of patented technology.

We outline the basics any financial professional should understand – including feed features, a comparison of similar feeds, and the fees associated with them.