Exegy’s David Taylor Talks Disruptive Technology with Nasdaq TradeTalks

Exegy’s Co-President and CTO David Taylor discussed the company’s role in disruptive capital markets technology on Nasdaq TradeTalks.

Exegy’s Co-President and CTO David Taylor discussed the company’s role in disruptive capital markets technology on Nasdaq TradeTalks.

Exegy responds to Waters Technology on the state of consolidation in the market data space.. Learn about consolidation in the industry.

Learn more about the future of market data in the cloud. Exegy provides Signum data to our partners with cloud marketplaces.

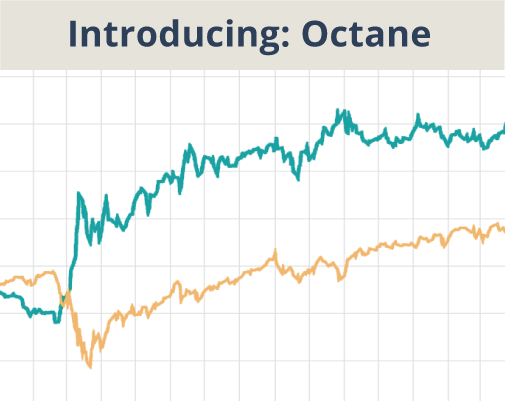

Introducing Octane, Signum’s newest long-short index strategy built off reserve order activity data. Learn more about Signum’s strategies

Migrating market data to the cloud can assist with development, compliance, and strategy backtesting. Whatever your use case, Exegy can help.

Growth in market data consumption and the migration to the public cloud has spurred more interest in managing entitlements.

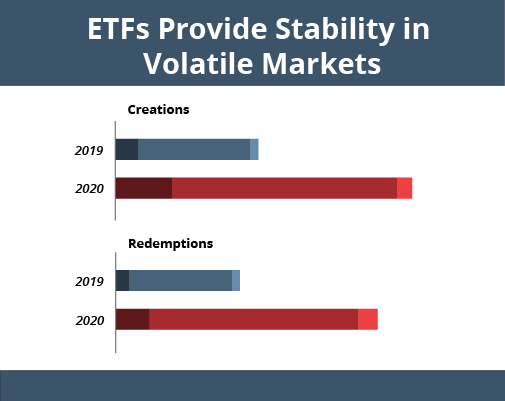

ETFs have allayed worries that they wouldn’t hold well up under volatile markets. Exegy’s basket calculation engine can help your firm keep up.

In February of 2020, the Securities and Exchange Commission (SEC, Commission) proposed a plan to expand the market data made available in the Securities Information Processors (SIP) feeds and to allow competing consolidators to register as alternative SIP providers. Exegy is a provider of SIP and proprietary data feeds that can help prepare for the…

Exchange-traded funds (ETFs) are a growing force in global markets. Firms can use technology to calculate a fund’s Net Asset Value and make trading decisions.

An introduction to Diesel, an alpha strategy based on Signum’s Liquidity Lamp end-of-day summary that can generate unique, uncorrelated alpha.