The Consolidated Audit Trail : What Firms Need to Know

As the impact of the Consolidated Audit Trail begins to reverberate through the industry, firms must make plans to ensure their compliance.

As the impact of the Consolidated Audit Trail begins to reverberate through the industry, firms must make plans to ensure their compliance.

We look at the link between the VIX and NBBO quote changes, and show how Exegy’s signal Quote Fuse can help you navigate volatile markets.

The extreme volatility of the past few weeks has dramatically impacted market data rates, but not in ways that you would expect.

An examination of market data from February 2020 shows how firms can gain from volatility using Exegy’s Signum signals.

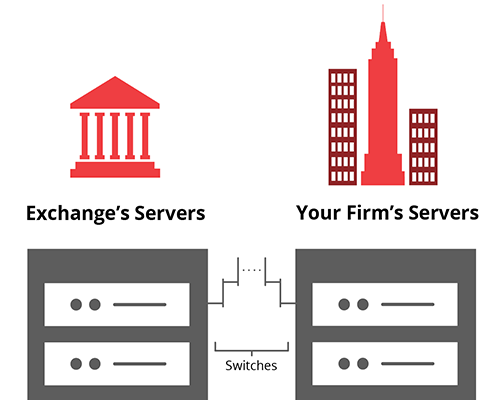

This article outlines common technology, networking, and trading strategy decisions needed to achieve ultra-low latency.

In real-time risk management of trading orders, third-party vendors can provide cost-effective high performance and scalability.

A firm with a with data science team can still benefit from vendor-provided AI signals, redirecting its team to differentiating strategies.

Using vendor-provided predictive signals can provide cost savings for firms seeking to pursue AI-enhanced trading strategies.

The true costs of options are not reflected in the low exchange fees. This article outlines the infrastructure and network costs of options market data.

Matching options market data to latency, market depth, and complex order needs is critical to a firm’s profitable trading.