PG&E’s Plummeting Shares Foreshadowed by Reserve Order Sellers

A review of PG&E reserve order activity as detected by Exegy’s Signum Liquidity Lamp shows the power of this signal.

A review of PG&E reserve order activity as detected by Exegy’s Signum Liquidity Lamp shows the power of this signal.

The US futures market maintains relatively centralized liquidity. Still, understanding the market structure ensures you have defined feed set requirements.

The unique structure of the options market creates conditions that impact liquidity, which can affect alpha capture and execution strategies.

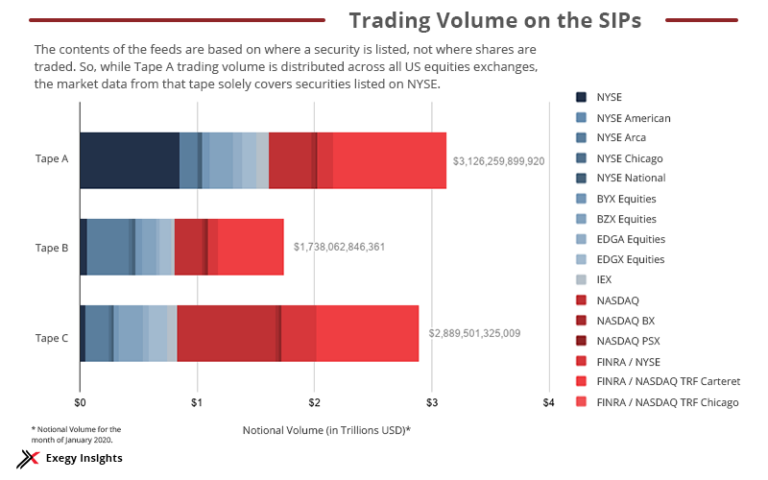

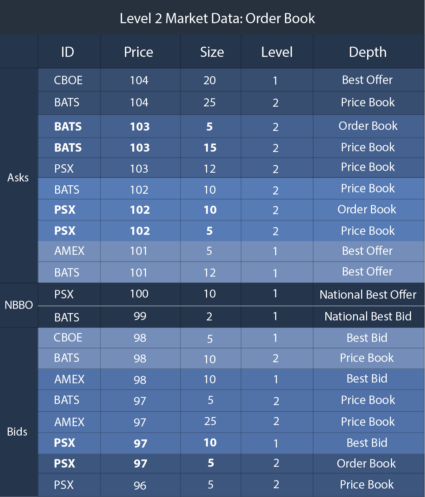

Market data is the third largest expense for many banks and broker-dealers. Understanding fees can help firms with infrastructure planning and budgeting.

We outline the basics any financial professional should understand – including feed features, a comparison of similar feeds, and the fees associated with them.

Know what market data you use and how it fits within your firm’s strategy to ensure proper market data budgeting.