Trading Reimagined

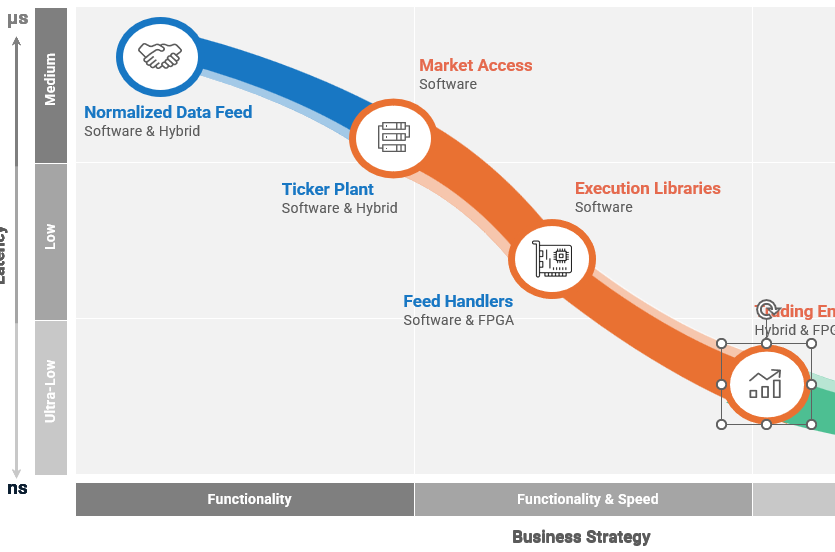

Trading and Execution Solutions Across the Latency Spectrum

Trading strategies are complex. Implementing and maintaining your trading technology shouldn’t be. Focus on the efficacy of your trading strategies, and let us handle the efficiency of your trading system.

Exegy’s execution solutions seamlessly integrate into your existing trading infrastructure, empowering firms to build and buy; or, as we like to say, you can maintain control and agility while encompassing both software and full FPGA deployments without sacrificing latency.

- A market-leading FPGA trading engine

- Off-the-shelf execution libraries

- Fully-managed market access gateways

- A robust options trading screen

Get to market faster whether you build or buy

Solution for any latency profile

Find the right technology to fit your business needs

Integrated normalized market data

Not sure what works best for you?

FPGA Market Access

We designed our FPGA trading engine specifically for market making, high performance trading and arbitrage strategies, allowing firms to accelerate existing trading algorithms without the investment usually required for FPGA-enabled performance.

Software applications manage the order execution protocol while FPGA logic to triggers and sends orders to the trading venue. The power of FPGA technology with the integration simplicity of a software solution delivers constant, deterministic, and jitter-free performance.

Listed Derivative Gateways

Reduce complexity and enhance the performance of your trading stack with a feature-rich, low-latency enterprise exchange connectivity solution. Deployed as a standalone or part of a horizontal exchange connectivity and risk layer. Includes comprehensive pre-trade risk, market data, reference data, market access, and drop copy, enabling easy integration to diverse markets.

Scale to more than 40 listed derivatives and fixed-income venues globally via a single fully normalized API or FIX interface.

Market Access Libraries

Ultra-low latency lightweight software libraries, providing normalized market access and quoting gateways to a wide range of global trading venues. Supports multiple asset classes including equities, derivatives, fixed income, foreign exchange, and commodities.

Designed to run in-process, and can be standalone or combined with Exegy’s SMDS market data software libraries.

Futures Options EMS

Manage complex options trading strategies with volatility modeling, pricing, and risk management tools. Exegy’s feature-rich trading screen and APIs are tailored to the needs of professional traders, supporting automated, algorithmic and click trading strategies in all major US and European futures and options markets. The platform also supports market making on OTC and call-around markets.